Pine Labs IPO GMP Update: The Grey Market Premium (GMP) for Pine Labs Limited remained unchanged on Saturday, 8 November 2025, reflecting steady investor sentiment in the unlisted market. According to market observers, the Pine Labs IPO GMP stands at ₹ 5.50 per share, indicating a muted but stable trend ahead of the upcoming trading week.

Despite limited subscription momentum so far, analysts expect participation to pick up as institutional and HNI investors begin to evaluate the company’s strong fintech fundamentals.

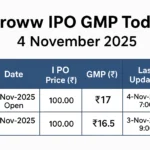

Pine Labs IPO Day-wise GMP Trend

| GMP Date | IPO Price (₹) | GMP | Estimated Profit* |

|---|---|---|---|

| 08-11-2025 | 221.00 | ₹5.5 | ₹368.5 |

| 07-11-2025 (Open) | 221.00 | ₹5.5 | ₹368.5 |

Subscription Status (as of Day 2)

The Pine Labs IPO has been subscribed 0.13× so far, with retail and institutional investors showing gradual participation. The fintech major, known for its payment solutions platform, is one of the most anticipated IPOs of FY25–26.

About Pine Labs IPO

- IPO Price Band: ₹215 – ₹221 per share

- Issue Type: Book Built Issue

- Face Value: ₹2 per share

- Lot Size: 67 shares

- Total Issue Size: ~₹6,000 crore (approx.)

- Listing On: NSE, BSE

Market View

Analysts note that, while the GMP remains modest, the company’s robust digital payments infrastructure and extensive merchant network offer long-term growth potential. The muted GMP trend may reflect cautious sentiment amid volatile market conditions, but Pine Labs’ fundamentals and strong revenue growth trajectory could attract institutional interest closer to the closing date.

Conclusion

The Pine Labs IPO continues to trade with a GMP of ₹5.5, showing no change from the previous day. Although subscription levels are currently low, market participants expect momentum to build as investors assess the fintech leader’s valuation and long-term potential.

Share