The IPO of Groww (Billionbrains Garage Ventures Ltd.) continues to attract attention from investors as the subscription enters its second day. As of Wednesday, 5 November 2025, the Groww IPO GMP (Grey Market Premium) remains unchanged at ₹14 per share, showing stability in market sentiment after a slight dip earlier.

Despite the flat GMP trend, analysts suggest steady retail participation and strong institutional interest could support a healthy listing premium.

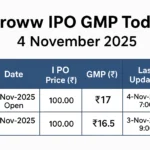

Groww IPO Day-wise GMP Trend

| Date | GMP (₹) | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|

| 05-Nov-2025 | ₹14 | ₹114 (14.00%) | ₹2,100 |

| 04-Nov-2025 (Open) | ₹14 | ₹114 (14.00%) | ₹2,100 |

Estimated profit based on one retail lot of 150 shares.

At the current GMP of ₹14, Groww shares are expected to list around ₹114 per share, reflecting a 14% potential listing gain over the upper price band of ₹100.

Groww IPO Details

| Particulars | Details |

|---|---|

| Issue Opening Date | 4 November 2025 |

| Issue Closing Date | 7 November 2025 |

| Price Band | ₹95 – ₹100 per share |

| Face Value | ₹2 per equity share |

| Issue Size | ₹6,632.30 crore |

| Fresh Issue | ₹1,060.00 crore |

| Offer for Sale (OFS) | ₹5,572.30 crore |

| Listing Exchange | BSE, NSE |

| Promoter Holding (Pre-IPO) | 28% |

IPO Lot Size and Investment Limits

| Category | Lots | Shares | Amount (₹) |

|---|---|---|---|

| Retail (Min) | 1 lot | 150 shares | ₹15,000 |

| Small HNI (₹2–10 Lakh) | 14 lots | 2,100 shares | ₹2,10,000 |

| Big HNI (₹10+ Lakh) | 67 lots | 10,050 shares | ₹10,05,000 |

Why Investors Are Watching Groww IPO

- Stable GMP: Maintains ₹14 amid moderate subscription levels.

- Strong Brand Value: India’s leading investment platform with 8+ crore users.

- Profit Turnaround: Reported ₹128 crore profit in FY25.

- Backed by Global Investors: Supported by Tiger Global, Sequoia Capital, and Ribbit Capital.

- Digital Ecosystem: Expanding into insurance, loans, and mutual funds.

Expected Listing Outlook

At the upper price band of ₹100 and a GMP of ₹14, Groww shares may list around ₹114, with an estimated gain of ₹2,100 per lot for retail investors.

Market experts see this as a moderate yet stable return, reflecting confidence in the company’s long-term growth.

Disclaimer

ShareGrey Market Premium (GMP) data is unofficial and may fluctuate daily. Investors should evaluate company fundamentals and consult financial advisors before making any investment decisions.