The IPO of Groww (Billionbrains Garage Ventures Ltd.) continues to witness steady demand from investors. As of Thursday, 6 November 2025, the Groww IPO GMP (Grey Market Premium) stands at ₹14.75 per share, showing a slight improvement compared to the previous session’s ₹14.

Despite this marginal uptick, analysts maintain that the grey market trend remains stable, indicating sustained investor confidence in Groww’s business model and strong retail participation.

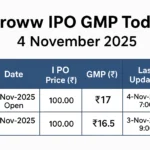

Groww IPO Day-wise GMP Trend

| GMP Date | GMP | Estimated Listing Price | Estimated Profit* | Last Updated |

|---|---|---|---|---|

| 06-Nov-2025 | ₹14.75 | ₹114.75 (14.75%) | ₹2,212 | 06-Nov-2025 |

| 05-Nov-2025 | ₹14 | ₹114 (14.00%) | ₹2,100 | 05-Nov-2025 |

| 04-Nov-2025 (Open) | ₹14 | ₹114 (14.00%) | ₹2,100 | 04-Nov-2025 |

💡 Estimated profit is based on one retail lot of 150 shares.

At Current GMP

At the current GMP of ₹14.75, Groww shares are expected to list around ₹114.75 per share, giving an estimated 14.75% premium over the IPO’s upper price band of ₹100.

Also Check: Lenskart Solutions IPO Allotment Status – Check Online on BSE, KFinTech, or NSE

Groww IPO Details

| Particulars | Details |

|---|---|

| Company Name | Billionbrains Garage Ventures Ltd. (Groww) |

| Issue Opening Date | 4 November 2025 |

| Issue Closing Date | 7 November 2025 |

| Price Band | ₹95 – ₹100 per share |

| Face Value | ₹2 per equity share |

| Issue Size | ₹6,632.30 crore |

| Fresh Issue | ₹1,060.00 crore |

| Offer for Sale (OFS) | ₹5,572.30 crore |

| Listing Exchange | BSE, NSE |

| Promoter Holding (Pre-IPO) | 28% |

IPO Lot Size and Investment Limits

| Category | Lots | Shares | Amount (₹) |

|---|---|---|---|

| Retail (Min) | 1 lot | 150 shares | ₹15,000 |

| Small HNI (₹2–10 Lakh) | 14 lots | 2,100 shares | ₹2,10,000 |

| Big HNI (₹10+ Lakh) | 67 lots | 10,050 shares | ₹10,05,000 |

Why Investors Are Watching the Groww IPO

- Stable GMP: ₹14.75 reflects consistent investor confidence.

- Strong Brand: One of India’s leading investment platforms with 8+ crore users.

- Profit Turnaround: Reported ₹128 crore profit in FY25.

- Global Backing: Supported by Tiger Global, Sequoia Capital, and Ribbit Capital.

- Diversified Offerings: Expanding into insurance, loans, and mutual funds.

Expected Listing Outlook

At the upper price band of ₹100 and a GMP of ₹14.75, Groww IPO may list around ₹114.75 per share, with an estimated profit of ₹2,212 per lot for retail investors.

Analysts expect a moderate yet positive listing backed by strong fundamentals and investor trust in India’s digital investing ecosystem.

Disclaimer

Grey Market Premium (GMP) data is unofficial and subject to daily fluctuations. Investors should assess company fundamentals and consult financial advisors before making any investment decisions.

Share